by

User Not Found

| Nov 28, 2018

Perhaps you’ve seen a recent headline noting that mortgage interest rates have recently risen to levels not seen in a long time. It’s true: earlier this month, the prevailing rate on a 30 year fixed rate mortgage crossed the 5% threshold for the first time since 2010. That being the case, you may be wondering if you’ve completely missed your last opportunity to lock in the historically low rates by refinancing. The fact is, I am reminded every day that members are always looking to borrow money to help them achieve their goals (and minimize the cost of that borrowing), and there are still many cases where refinancing may make a lot of sense.

The first thing to remember is that while mortgage rates have risen from the extremely low levels that we’ve seen through most of the past decade, they are still relatively low when put in a historical context. Those who remember buying a home in the early 1980’s when the prevailing rate was a whopping 17% probably chuckle when they hear someone complain about a 5% rate. The other thing to keep in mind is that mortgage rates are comparatively lower than other borrowing alternatives, namely credit cards or personal loans. So before we bemoan the state of mortgage rates in 2018-2019, let’s keep in mind that they are still very compelling.

At this point, you are undoubtedly thinking, “Yeah, 5% may be a low rate, but I already have a 3.75% 30 year fixed rate mortgage!” If you’re in this category, I say “Congratulations!” You timed the market well, and you now have an interest rate that is unlikely to be beaten any time soon. Yet there are still reasons why even you may want to consider refinancing. Let’s go through a few considerations below.

You are in Need of Cash to Finance a Home Improvement or Other Large Expense

Home improvements can be pricey. A screened-in porch, a finished basement, new furniture, even interior painting—the expenses can really add up. Maybe it’s the dream vacation you’ve been wanting to take, or an ever-growing college tuition payment. If you don’t have the money saved up, it has to come from somewhere. And as mentioned above, a loan secured by your home (whether it’s a mortgage or a home equity loan) typically carries a much lower rate than alternative loans like a credit card or a personal loan. So would it really make sense to refinance that fantastic 3.75% interest rate?sc It might! Here’s why.

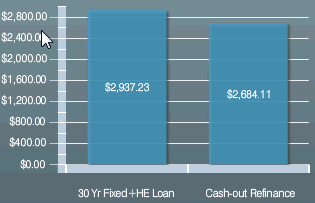

Let’s say that you owe $400K on your first mortgage at the aforementioned rate of 3.75%, but you need $100K to finance that home improvement project. You decide to borrow against the equity in your home in order to finance it. You are quoted a rate of 5.49% on a 10 year fixed rate home equity loan, which would put your combined monthly principal & interest payment at $2,937.23. Your blended weighted average interest rate on the entire $500K would be approximately 4.1%.

Alternately, you could simply do a cash-out refinance on the entire balance, netting you the same $100K to finance the project. You would replace your $400K loan with a new $500K fixed rate loan at 5%. Your new monthly principal and interest payment would be $2,684, over $250 per month less than the other option. Yes, your weighted average interest rate would be higher at 5%--not the optimal solution for someone who is looking to minimize their interest costs. Yet it’s certainly a viable option if monthly payment is your chief concern. You’d also get the added convenience of having a single loan payment instead of two.

You Want to Consolidate Debt

Nearly 40% of Americans carry credit card debt. According to credit card comparison site creditcards.com, the average card APR in October, 2018 was 17.1%, with many cards exceeding 20%. If you find yourself in this category, it may be worth considering whether to consolidate all your debts into a cash-out refinance. The math is the same as in the prior section. You’ll want to look at your total combined monthly payment as well as the weighted average interest rate on your total debt balance. It may surprise you to see just how much a relatively small card balance at those extremely high rates can increase your weighted average borrowing costs. Again, the convenience of a single payment can’t be overstated. The one thing to keep in mind here is that you are replacing unsecured credit card debt with debt secured by your home. So be sure to make those payments on time!

You Only Plan to be in the Home for a Few More Years

Returning to that 3.75% rate you have: pretty low, for a 30 year fixed rate loan. But are there even lower rates available? In many cases, yes! You’ve heard me sing the praises of adjustable rate mortgages (ARMs) before. Rates for short-term ARMs are far lower than those on 30 year fixed rate mortgages. The reason is simple: When your rate is locked for a full 30 years, there is a cost for that long-term rate security. Lenders put a premium on the rate because they are shouldering the risk that rates may rise in the future. But with a short-term ARM, the borrower assumes that risk.

A 3/1 ARM carries a fixed rate for the first 3 years, then it adjusts every year thereafter. In other words, if prevailing rates rise after the fixed-rate period expires, the rate on the loan will increase as well. However, if you don’t plan to be in the house in three years, then the rate adjustment becomes irrelevant. If you can save a few thousand dollars over the next 36 months, then a refinance is definitely worth exploring.

Think you might benefit from exploring a possible refinance no matter how great your interest rate is? Contact one of our expert Mortgage Loan Consultants for a no-cost consultation. Worst case, we’ll tell you how great your rate is and that you’re in the best possible situation. And who doesn’t want to hear that?