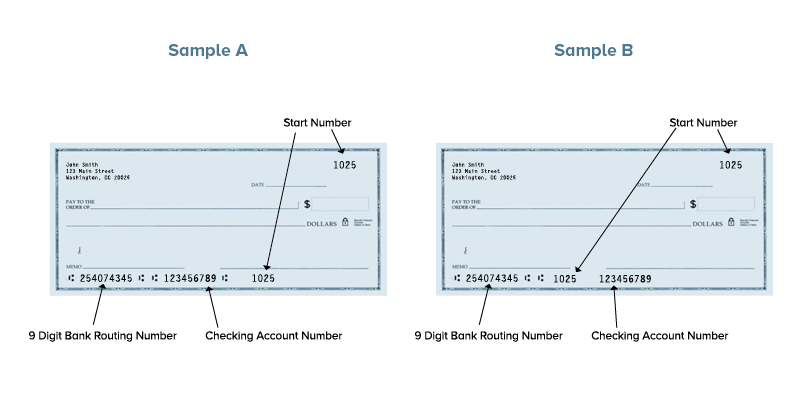

For direct deposit into your

checking account, please use the account number and routing number as found on the bottom of your checks. Employers often request a voided check to verify your account information.

For direct deposit into your

savings account, you will need to provide your member account number and the Congressional Federal routing number, which is 254074345. Your member account number can be located in the upper right of the screen of Online Banking.

Note: If you do not have checks or your employer requires a signed form from the credit union to establish direct deposit, please contact Member Services at 800.491.2328 (Toll free), 703.934.8300 (Local), or email@CongressionalFCU.org.