Contest ended March 31st, 2019.

This spring, we awarded three $3,000 scholarships to graduating high school seniors based on their academic standing and their responses to an essay question:

It's never too early to start building a sound financial foundation for college and beyond. If you were to design a financial literacy course or app for your school, what would be the most important tools and resources featured in your program?

2019 saw a record number of entries for our annual scholarship. The Board selected the winners for their thoughtful explorations.

We're proud to have the authors as members, and we wish them all the best in their bright academic futures and beyond.

Read the winning essays!

Essay #1

As a child, I was always interested in keeping up with my financial resources. At five, I decided to open my fjrst savings account. After saving up most of my Tooth Fairy and Christmas money, I walked into Congressional Federal with a bright green piggy bank and a determined smile on my face. By the time I was thirteen, I was ready for my first checking account and debit card. I was ecstatic when the shiny card graced my mailbox, my name engraved on the front, and the long black strip for swiping on the back. At sixteen was my first job, at seventeen, my second; I was adamant about keeping my funds steady and secure.

During my junior year of high school, every student was required to take an online financial literacy course. Even I, a student interested in finance, found this course to be mundane and meaningless. I was faced with many terms and future responsibilities that were not explained well in the course. Luckily, I had an amazing teacher that was able to right these wrongs and re-engage me in the material. But what about those students who didn't have my teacher? How would they learn to stay out of debt, to understand ATM fees, to lease a car?

If I were to design a new financial literacy course, I would first make it easily accessible and entertaining. In today's digital world, everything is so efficient that many students will feel uninterested in the first few minutes of an activity if it is not adequately designed. The most effective way to get students engaged: incentive. Coming from a high-schooler, students tend to pay more attention when there is a reward at the end. I know that it helped me when I went into Congressional to make a deposit as a child and I was given a token gift.

Additionally, in the course, students would take on a virtual character and walk them through the steps of learning how to save. The students could start with their avatar at a young age, helping them grow and develop their savings accounts. These app users would choose what they want their characters' jobs to be, potentially based on what the students also want to do later in life. They can earn virtual money, then organize it into categories where they want to spend or save it. Once they reach maturity, the students could then help this character learn to effectively buy a house, car, and plan for a family. They could even walk them through simple processes like filling out a deposit ticket. Rather than treating it like a course, these students could think of it like a video game competition. At the end, whoever has the most saved for retirement, wins and gets the first place pnze.

Furthermore, within this online course, there could be modules that teach the students key concepts. When their character hits a milestone, such as their first savings account, first job, or first credit card, they would be presented with a short video from their "advisor". This advisor will tell them the new features of the app that will be added with this milestone, and tips for doing well in this next stage of life. While the advisor might not seem like a virtual teacher, that is exactly their role in the course. They can be there for questions and directions if the student is having trouble. Also, when it comes to assessing the student's progress in this financial literacy course, a short, five-question quiz about what they have learned in the previous stage of their character will pop up at every milestone. This ensures the students are learning and engaging in the material.

Personally, I think any task is more interesting when presented in an alternative, entertaining form. This :financial literacy app simulates what students will eventually face as they mature, and makes the content less overwhelming when presented as a friendly competition. Not only would this app allow the student to learn, it allows them to learn independently. While this app may not exist yet, thinking about its development inspires me as an eventual computer science major. With adequate programming skills, I will be able to change the financial futures of millions of students.

Essay #2

This semester I am taking a Personal Money Management course, and after only a few weeks, the class has enlightened me about how to build a sound financial foundation for my life in college and afterwards. If I were to design a website (that could also be downloaded as a smartphone application) for students my age, especially those who have not had an opportunity to take this class, it would be called “Loans, Taxes, and Bonds, Oh My!” and it would look something like this. The homepage would have a list of topics that are the primary categories: “Choosing a Career,” “Taxes,” “Banking,” “Investing,” “Credit,” “Insurance,” “Budgeting,” and “Retirement.” Each of these topics would lead to a page with further details that break down the what, why, and how, along with related articles and videos. Scrolling down on the main page would be a series of articles on recent news related to finances or that answer often asked questions. The articles would be from a wide range of sources, such as the Wall Street Journal and other news outlets, the Internal Revenue Service (IRS) website, Entrepreneur.com, and many other websites with financial advice and information. At the top of the homepage, there would be a search bar and in the bottom corner would be “Taxbot.”

Recently, companies such as TurboTax have started to offer the help of on-call accountants to give people tax advice. Having a person to talk to makes all the difference in understanding anything. That is why students are taught by teachers, not just handed a textbook and expected to understand everything. However, a more flexible method would be to have a machine answer certain questions. This machine, “Taxbot” or some other clever name, could automatically answer questions, and for further questions there would be contact information for a live chat with a certified accountant or financial advisor (a similar approach is used by colleges for the admission process).

It is one thing to read and be taught something, but there needs to be hands-on practice with simulations and games. A teacher can tell students how to do something, but the student can never really learn until they take control and utilize the knowledge given to them. There are multiple personal finance games already out there such as following a stock or simulating having a bank account, but there could be a game that combines all of these financial aspects called “Green Brick Road.” In this game the user would create their own virtual life from the beginning of high school until retirement as they go to college, choose a career, start a family, and retire. Every few times the user taps to add a year, a new financial dilemma or opportunity would arise. This could include applying for a job, starting a bank account, paying for an accident, or buying a house. The player could also choose investments for retirement that they would track. Along the way, the game would give financial tips and advice along with links to related resources. Once retirement is reached, the player would be given tips on what could have been done differently to better secure their financial standing. This game could be played again and again with different circumstances and settings, and it would be more widely used and practiced among high schoolers and college students since this generation is constantly on their phones.

As a working young adult, entering college in a few months, it is important that I am prepared—or at least trying to prepare myself—for the next phase of my life. It is not difficult to understand one’s personal finances, but often people my age do not make the effort to learn about it because they do not know where to look or it just seems boring. With an app that is straightforward, easy, and even fun, such as “Loans, Taxes, and Bonds, Oh My!” and its life-simulation game, “Green Brick Road,” the task of learning about personal finance will be more interesting and the world of independent adulthood will seem less daunting.

Essay #3

If I had to create a financial literacy course, it would be based on leasing, financing, or saving to buy a car. I believe many people fall into a trap, because they don't know the necessary precautions. I would start with the basics, such as vocabulary terms everyone should know when exploring and learning the car buying world. Leasing is using a car for a fixed period of time and for an agreed upon cost and mileage.

Financing is placing a down payment on the car and then paying monthly until it's paid in full. Taking public transportation allows a buyer to save a sum equal to all or a portion of the car.

Each of these options has its pros and cons, and to make an informed decision a buyer would have to know each option. Leasing is better than buying if you need to have lower payments or plan on to get a different car within a few years. Once you buy a car, you are financially responsible for wear and tear, but on the other hand, you wouldn’t have an excess mileage fee as you might, if you lease. If you plan to keep the car longer than a few years then purchasing the car is more sensible. When thinking about your alternatives, you have to consider other factors,such as, your daily or monthly expenses. Once you have learned the vocabulary of the car world, then you can proceed to the next step.

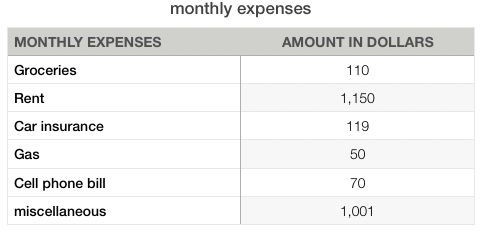

Below I have created a scenario with fictional numbers to demonstrate the types of expenses one could have to acknowledge and reconcile before deciding if buying, leasing, or saving would be best for the buyer.

I believe this course would be important and a help to a variety of people.

Without this knowledge, many people may end up falling into to quick and uneconomical car transactions and acquire mountains of long term debt. If people were to become more educated on topics that touched their daily financial lives, they could have less debt, more knowledge, and greater tranquility.